Covid-19 resources for the c-id community

Governor’s Office regarding resources and business assistance:

https://coronavirus.wa.gov/

City of Seattle helpful information and links for programs and services for those significantly impacted by the COVID-19 pandemic.

http://www.seattle.gov/mayor/covid-19

http://www.seattle.gov/office-of-economic-development/covid-19/businesses

Get Vaccinated & Boosted!

As a reminder, Washington state health officials are encouraging everyone to be fully vaccinated and boosted.

Children between the ages of 5-11 years old are also eligible to get the Pfizer COVID-19 vacc ination clinics for SPS students age 5 and above across the City of Seattle.

Visit https://www.seattleschools.org/news/vaccine-clinic/ to find a clinic at your child's school or nearby. You can translate the page into your preferred language by clicking the "G" button on the top right of the page.

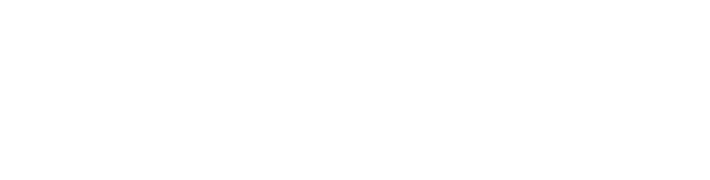

updated covid-19 booster

CDC Recommends the first updated COVID-19 Booster. Schedule vaccines or boosters with local pharmacies or general family physician.

ICHS patients and non-ICHS patients can walk in to clinic pharmacies at ICHS' International District, Holly Park and Shoreline clinics Monday through Friday from 9:00 am to 4:00 pm (availability based on limited supply). Pharmacies vaccinate individuals six months and older.

For more information about scheduling a vaccine/booster appointment, visit https://www.ichs.com/covid-19-vaccine-appointments

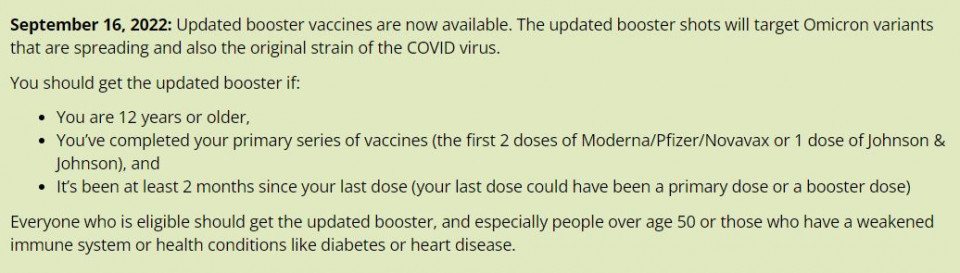

KING COUNTY VACCINATION VERIFICATION LIFTed MARCH 1, 2022

The vaccination verification policy will no longer be in effect as of March 1, 2022.

Businesses will no longer be required to check proof of customers vaccination, or a negative COVID-19 test, to enter restaurants and bars, indoor recreational events and establishments, or outdoor events. Businesses and organizations may still choose to implement their own vaccination verification policies.

從 2022 年 3 月 1 日開始,金縣將廢除疫苗驗證政策。人們進入餐廳和酒吧、 室內娛樂活動和場所或參加戶外活動時,將不再需要出示疫苗接種或 COVID-19 檢測陰性證明。企業仍能選擇維持自己的疫苗接種或檢測證明條例。

Bắt đầu từ ngày Ngày 1 Tháng 3 Năm 2022, chính sách xác minh việc tiêm chủng ở Quận King sẽ không còn hiệu lực.

Các doanh nghiệp sẽ không cần phải kiểm chứng bằng chứng chích ngừa của khách hàng, hoặc kết quả xét nghiệm âm cho COVID-19, để vào nhà hàng và quán bar, các sự kiện và cơ sở giải trí trong nhà, hoặc các sự kiện ngoài trời. Các doanh nghiệp và cơ quan tư nhân vẫn có thể thực hiện các chính sách xác minh về việc tiêm chủng của riêng mình.

Resources to answer questions about vaccine verification end

Resources and Posters for your business:

Download the Vaccine Verification "Keep Each Other Safe" Poster

Download the "How to Verify Vaccine Status" Poster

king county indoor MASK MANDATE ended march 12, 2022

What does that mean? Read this blogpost for more info.

Beginning March 12, masks will no longer be required in many indoor public spaces:

- schools, childcare facilities, libraries

- Restaurants and bars

- Places of worship

- Gyms, recreation centers, and indoor athletic facilities

- Grocery stores, businesses, and retail establishments

Masks are still required at:

- Healthcare and medical facilities, including hospitals, outpatient, dental facilities, and pharmacies

- Long-term care settings

- Public transit, taxis, rideshare vehicles (federal requirement)

- Correctional facilities

Private businesses, organizations, schools and childcares may still choose to implement their own mask requirements. Please respect people’s choices to continue to wear a mask.

Helpful signage + templates for your business

About masks

(memo provided by public health king county)

Even when coronavirus transmission levels in King County are lower, the virus has not gone away. Masks remain an important tool in helping slow the spread of COVID-19. People who are immunocompromised, unvaccinated, or who do not feel well should still wear masks to protect themselves and others when in indoor public spaces.

Remember: You can still choose to wear a mask no matter the circumstance. If you don’t feel ready to stop wearing a mask, that’s perfectly understandable.

CDC recommends changes to isolation and quarantine for COVID-19: read the update here.

Employee Health & Safety

Communicate with employees and customers about what you’re doing to keep the business/establishment clean and safe. Emphasize hand washing with posters and reminders, prioritize regular disinfection of frequently touched surfaces and objects, and urge employees to stay home if they are exhibiting symptoms.

Washington state laws also requires employers to keep a safe and healthy workplace. Take a look at these ongoing guidance and health mandates.

Labor & Industries offers a variety of services. In case you may here is a list of specific departments. Partners and business owners can click on this link to find specific points of contacts for different needs.

Paid Sick & Safe Time (PSST) Ordinance:

In Seattle, the law requires employers to provide all employees with paid sick and safe time. This includes full-time, part-time, temporary, exempt, and non-exempt employees. Please call the Seattle Office of Labor Standards (OLS) at 206-256-5297 or visit Office of Labor Standards PSST page.

Unemployment Services:

The Washington State Employment Security Department has programs designed to help individuals and employers impacted by the COVID-19 outbreak. They have an easy-to-read comparison guide listing some of the most common scenarios that may occur and benefits that may apply. More information for workers and businesses here: esd.wa.gov/newsroom/covid-19.

Safety tips for your business

The best thing to do is be great neighbors and community members and report what you see happening in the neighborhood if it warrants police presence. If you suffer property damage, please report this to Seattle Police so they can investigate the crime and you can receive a case number. In addition, you can fill out the City of Seattle property damage form to better track the impacts.

Chinese Translation | Vietnamese Translation

Preparing Your Business

- Contact your insurance professional to determine your coverage for these events.

- If you have a security system, make sure it’s working and turned on before you leave your business.

- Double-check doors and windows are locked at businesses and residential buildings.

- Pull in any loose items that can be used for property damage, such as rocks.

- Have a representative available who has the authority to make decisions to protect your assets.

- Determine if you need to close your business early.

Train Employees on Security Procedures

- Create an action plan for how employees should react if there is an active violent situation outside of your business. Make sure that everyone knows important information like how to properly lock down or evacuate the building in an emergency.

- Be vigilant and report crimes immediately to 911.

- Remember lives are more important than property. Make sure that everyone knows important information like how to properly lock down or evacuate the building in an emergency.

Secure Your Property

- Check for items that can be thrown or used to damage property on the streets (i.e. glass bottles, rocks, etc.).

- Secure all open areas like outdoor seating areas, garages, dumpsters, and recycling bins as much as possible and to remove all combustibles that cannot be secured.

- If possible, install plywood to block your windows.

Lights On

- Well-illuminated premises will discourage suspicious activity and make it easier for pedestrians to spot.

Supplies for Your Business

You can find easy to install cameras and security alarms as well as plywood and other supplies needed for securing your business at Home Depot and Lowe’s nearby.

Temporary free safe start (street use) Permits

Seattle Department of Transportation (SDOT) is offering streamlined, free temporary permits for outdoor cafes, retail merchandise displays, food trucks, vending carts, and fitness activities that are valid through a sunset date in January 2023. They are also offering temporary street closures to support restaurants and retail operations.

- Temporary Outdoor Café Permit: A business owner should request this permit if they are a restaurant owner who would like seating on the sidewalk or in the curb space parking. An additional permit from Washington State Liquor and Cannabis Board will be required to serve alcohol. Download the Alteration Request Form to begin the process. Please contact the WSLCB with any questions about alcohol service.

- Temporary Merchandise Display Permit: A business owner should request this permit if they are a retail business owner who would like to expand operations outside into the sidewalk or in the curb space parking (note that this includes the point of sale). Merchandise display in the curb space cannot be located on principal arterial streets.

- Temporary Vending Permits: A business owner should request this permit if they are a vendor who would like more flexibility on their vending location and duration. This includes street and sidewalk locations for food trucks and carts. You will need to have your King County Dept of Public Health Mobile Food Unity permit or state if exempt, your Seattle Fire Marshal permit if using open-flame or liquid petroleum gas, as well as your Seattle Business License.

Apply for a Free Permit here. Please note, businesses will also need to submit an application for a Certificate of Approval (the fee will also be waived).

City of Seattle Business Taxes

Every business must file and report to the City, even if you had no activity or do not owe any tax. Your business does not owe general business and occupation (B&O) tax if your net annual income is less than $100,000, but you must file. Go to www.filelocal-wa.gov

Questions? Call 206-654-8484 or email tax@seattle.gov

- Apply for a business license

- Renew a business license

- File your business taxes

- Pay your business taxes

Create an account with your Seattle Business License Tax Certificate Number, or your Washington State business license number (UBI, Uniform Business Identifier). Find those numbers by searching for your Seattle business: www.seattle.gov/license-and-tax-administration/find-a-licensed-business

The Seattle business tax is not the same as the Washington State business tax. You must file your Seattle taxes separately from your state taxes. To learn more about the state tax, visit the Washington State Department of Revenue: https://dor.wa.gov/taxes-rates/business-occupation-tax

B&O Tax Deferment Info

Effective immediately, the City of Seattle Department of Finance and Administrative Services (FAS) will defer business and occupation (B&O) tax collections for businesses that have annual taxable incomes of $5 million or less and that pay city taxes quarterly. This will allow small business owners increased flexibility during a period of financial duress caused by the COVID-19 outbreak. If you have questions, please call (206) 684-8484 or email: tax@seattle.gov